|

207 Abbey Lane Lansdale, Pennsylvania 19446 215-855-1800 |

5201 Ocean Avenue #2007 Wildwood, New Jersey 08260 215-990-6663 |

Specializing in Real Estate Appraisal and Property Tax Consulting

A Professional Courtesy of:

|

Specializing in Real Estate Appraisal and Property Tax Consulting |

| SPRING 2007 |

|

|

In This Issue: |

|

Difficulty of Easement Valuation Valuation professionals are often engaged to provide opinions of market value of easements, real property interests that convey use but not ownership of a part of an owner's property, usually for a specific purpose. Since easements are rarely sold, their valuation poses certain challenges to the appraiser.Easements arise as a result of an agreement between parties, by adverse possession or by governmental exercise of the power of eminent domain. Types of easements include those for the purpose of ingress and egress, road widening, utility access, public pedestrian passage, facade preservation and conservation. Easements may be on, above or below the surface of a site, temporary or long term. Public entities often acquire temporary easements for the purpose of road construction. These easements expire within a few months, but other easements may last many years or into perpetuity. The property that is burdened by an easement is termed the servient tenement, while the property whose owner acquires the easement is known as the dominant tenement. An easement that is attached to, benefits and passes with the conveyance of the dominant estate (i.e., runs with the land) is known as an easement appurtenant. Given the dearth of sales of easements, settled valuation methodology involves before-and-after appraisals of the affected property. If, for example, a piece of land lacks access to a public right-of-way, the value of an easement providing such access may be reasonable based upon the value differential of the land with and without such access. In the instance of easements the government wishes to acquire by eminent domain, the accepted valuation premise is the difference between the values of the servient estate before and after the taking, since property owners must be justly compensated for property taken by condemnation. The property value after the government takes the easement may be negatively affected by such factors as reduced developmental potential and increased construction costs. Much attention has been given recently to valuations of conservation easements, facade easements and preservation easements since such valuations serve as the basis for deductions in federal income tax filings. Indeed, the IRS has begun to carefully scrutinize such valuations so as to reduce instances of abusive deductions, while Congress recently passed a new law redefining the tax benefits of conservation and facade easements. "Rules of thumb" accepted in years past should not be utilized in such appraisals. Well grounded support for any conclusions regarding value diminution is essential for both appraisers and taxpayers. |

Appraisal Review: Making a List and Checking It Twice Real estate appraisers are often engaged to review and critique appraisal reports prepared by others. Private sector institutions, such as banks, savings and loans, and life insurance companies, employ staff appraisers whose reviews may be used for purposes such as loan underwriting, decision-making by asset manages and rebuttal testimony in litigation. Such reviews often serve as quality control or auditing mechanisms. Governmental agencies utilize appraisal reviews to insure compliance with various laws and regulations. Independent "fee" appraisers may be hired as well. Reviews can be broadly categorized as either administrative or technical. Administrative reviews, also referred to as compliance reviews, are often performed by non-appraisers. Such reviews typically address the compliance of the report with basic client-dictated content specifications. Technical reviews, on the other hand, require that the reviewer give an opinion as to whether the report's analyses, opinions and conclusions are appropriate and reasonable. Such reviews should be -- and typically are -- performed by qualified appraisers.

Reviews can be broadly categorized as either administrative or technical. Administrative reviews, also referred to as compliance reviews, are often performed by non-appraisers. Such reviews typically address the compliance of the report with basic client-dictated content specifications. Technical reviews, on the other hand, require that the reviewer give an opinion as to whether the report's analyses, opinions and conclusions are appropriate and reasonable. Such reviews should be -- and typically are -- performed by qualified appraisers.Technical reviews are further delineated as either desk reviews or field reviews. In a desk review, the reviewer checks the accuracy of calculations, the adequacy and relevance of the data and the adjustments made to it, and the appropriateness of the employed methodology. Then he or she expresses an opinion as to the reasonableness of conclusions. Field reviews cover all of the areas of a desk review but may include inspection of the property and its comparables, full or partial verification of the market data and the gathering of additional data. The performance of an appraisal review requires that the reviewer clearly set forth the scope of work in the review process. The scope of work must be sufficient to produce a credible opinion, given the intended use of the review. A technical review must be done in compliance with Standard Rule 3 of the Uniform Standards of Professional Appraisal Practice (USPAP), which sets forth requirements for both developing opinions and reporting such opinions regarding the work under review.  In addition, the reviewer must comply with the USPAP competency rule that requires the reviewer to possess the knowledge and experience to complete the assignment competently. For example, a review appraiser without knowledge of and experience in the valuation of hotels would be unlikely to competently review such a property's valuation. The reviewer must conduct the review and report the resulting opinions in a manner reflecting independence and objectivity.

In addition, the reviewer must comply with the USPAP competency rule that requires the reviewer to possess the knowledge and experience to complete the assignment competently. For example, a review appraiser without knowledge of and experience in the valuation of hotels would be unlikely to competently review such a property's valuation. The reviewer must conduct the review and report the resulting opinions in a manner reflecting independence and objectivity.Well-trained and experienced appraisers are valuable resources to many types of clients. Such professionals are well-positioned to make significant contributions to the process of quality control and due diligence. |

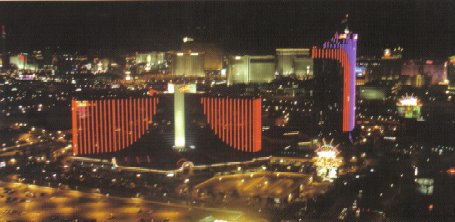

Induced Demand For Hotels: Is It Real? Induced demand has been the source of significant controversy in recent years. "The Dictionary of Real Estate Appraisal" defines induced demand as "a component of latent demand created by aggressive marketing efforts, the opening of a major demand generator, or the provision of new amenities." Still, many people are confused as to what it is, what it is not and how it is measured.Some have argued that induced demand does not really exist but is merely a theory posted by developers pursuing financing for their projects. Yet in certain situations induced demand clearly exists and can be measured. Demand may or may not be induced, depending upon the specifics of the market and the potential generator of such an increase. The concept of induced demand is most frequently applied to the hospitality sector; a prime example is the Las Vegas hotel market. The premise is that the addition of new large-scale hotels with casinos and convention meeting space creates (induces) demand for such properties beyond that which existed previously. Whether this has proven to be true or not is beyond the scope of this article.  Other examples of development that may create induced demand include hotels in close proximity to convention centers or destination entertainment centers/theme parks. The movement of major employers to new areas may result in induced demand for office space, housing and retail facilities. Conversely, induced demand may be negative if the generator in question pulls demand from one market area and shifts it to another. Numerous examples of negative induced demand have arisen in smaller cities across the United States, such as when a major retailer (e.g., Wal-Mart) moves from one submarket to another, taking significant retail drawing power with it.

Other examples of development that may create induced demand include hotels in close proximity to convention centers or destination entertainment centers/theme parks. The movement of major employers to new areas may result in induced demand for office space, housing and retail facilities. Conversely, induced demand may be negative if the generator in question pulls demand from one market area and shifts it to another. Numerous examples of negative induced demand have arisen in smaller cities across the United States, such as when a major retailer (e.g., Wal-Mart) moves from one submarket to another, taking significant retail drawing power with it. Those who discount the existence of induced demand assert that the proposed generator simply takes demand from existing properties rather than creating additional demand in a given market. This may certainly be true in specific situations; however, it cannot be accepted in all situations without further analysis.

Those who discount the existence of induced demand assert that the proposed generator simply takes demand from existing properties rather than creating additional demand in a given market. This may certainly be true in specific situations; however, it cannot be accepted in all situations without further analysis.The measurement of induced demand should realistically be limited to the specific market area in which the demand generator's influence is likely to be realized. The increase in one market due to induced demand will tend to be reflected in a decrease in other markets. Thus, the analysis of the potential for induced demand of a hotel in context of the national lodging market is obviously nonsensical. Instead, such analysis should properly be confined to the specific market area in which the new development competes. If, for example, RevPAR (revenue per available room) for relatievely similar hotels in a particular submarket increases or at least remains unchanged following the introduction of a new competing hotel and if the new hotel achieves forecasted financial performance, induced demand may well be the explanation, assuming that such operating results exceed growth that would otherwise have occurred. Induced demand clearly exists in some circumstances but not in others. Careful analysis is crucial in making such a determination. |

The Appraisal Industry: Regulated for Your Protection The activities of professional real estate appraisers are governed by numerous state and federal laws, regulations, banking examining circulars, executive orders and memoranda of multiple governmental agencies as well as codes of ethics and standards of the professional organization(s) in which an appraiser holds membership. The most important of these codes of ethics and standards is the Uniform Standards of Professional Appraisal Practice (USPAP). All valuation professionals are subject to USPAP, which was developed during 1986 and 1987 by the Ad Hoc Committee on Uniform Standards of The Appraisal Foundation, the organization authorized by Congress to set appraisal standards and qualifications. The Appraisal Standards Board of The Appriaisal Foundation develops, publishes, interprets and amends USPAP.Prior to USPAP, the establishment and enforcement of ethics and standards was primarily undertaken by professional organizations such as the Appraisal Institute. However, appraisers who were not approved by nor members of such organizations were obviously not required to comply with their standards, resulting in a hit-or-miss system without an industry-wide code. The well-publicized problems resulting from imprudent loans made by savings and loan institutions and banks in the mid- to late-1980s served as a catalyst for change.  Congress dictated the reform of the profession when it passed the Financial Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA). This legislation required drafting of extensive regulations to create uniform principles and standards for all appraisals done for federal and state savings and loans and banking institutions, as well as for the five federal financial institutions regulatory agencies: the Federal Reserve System, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, the Office of Thrift Supervision, and the National Credit Union Administration.

Congress dictated the reform of the profession when it passed the Financial Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA). This legislation required drafting of extensive regulations to create uniform principles and standards for all appraisals done for federal and state savings and loans and banking institutions, as well as for the five federal financial institutions regulatory agencies: the Federal Reserve System, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, the Office of Thrift Supervision, and the National Credit Union Administration.All states have adopted USPAP as the controlling body of standards for real estate appraisals. The state-issued appraiser licenses currently available are the State Certified General Real Property Appraiser license, which allows an appraiser to value any residential unit of one to four families regardless of value. An additional license, which is recommended or used by many states is the State Licensed Appraiser license, which permits its holder to appraise commercial property up to $250,000 and one-to-four-family residential units worth up to $1 million.  Real estate appraisers must be certified either as a residential real property appraiser (which allows an appraiser to value any residential unit of one to four families) or as a general appraiser (allowing an appraiser to value any type of real property) by the state in which they work. Some appraisers instead hold a license that allows them to appraise commercial property valued up to $250,000 and one- to four-family residential properties valued up to $1 million. Some states require nonresident appraisers to obtain temporary practice permits before performing valuations. Requirements for temporary practice permits may depend on whether the specific assignment is to be used in a federally-related transaction. Some states' regulations allow for reciprocity with other states in terms of certification. Numerous other federal laws and regulations affect real estate appraisers, particularly those involved in residential valuation.

Real estate appraisers must be certified either as a residential real property appraiser (which allows an appraiser to value any residential unit of one to four families) or as a general appraiser (allowing an appraiser to value any type of real property) by the state in which they work. Some appraisers instead hold a license that allows them to appraise commercial property valued up to $250,000 and one- to four-family residential properties valued up to $1 million. Some states require nonresident appraisers to obtain temporary practice permits before performing valuations. Requirements for temporary practice permits may depend on whether the specific assignment is to be used in a federally-related transaction. Some states' regulations allow for reciprocity with other states in terms of certification. Numerous other federal laws and regulations affect real estate appraisers, particularly those involved in residential valuation.Recently, federal agencies, including the Department of Housing and Urban Development and the FBI, have increased their focus on residential mortgage fraud and the role of appraisals in its perpetuation. Lenders and appraisers that engage in such fraudulent activities may expect to be dealt with harshly. Real estate valuation professionals are highly regulated and required to perform their services honestly and competently. Clients of such professionals benefit from such regulation. |

|

Next Issue: |

Home | Newsletters | About Us | Contact Us |