|

207 Abbey Lane Lansdale, Pennsylvania 19446 215-855-1800 |

5201 Ocean Avenue #2007 Wildwood, New Jersey 08260 215-990-6663 |

Specializing in Real Estate Appraisal and Property Tax Consulting

A Professional Courtesy of:

|

Specializing in Real Estate Appraisal and Property Tax Consulting |

| WINTER 2011 |

|

|

In This Issue: |

|

Net Leased Properties: An Investor's Dream With over 157 failed banks this year, and the likelihood of more failures in the months and years to come, Commercial Real Estate (CRE) is experiencing record disruption within all asset types. The speculative lending market is all but dead, and the few remaining banks lending on CRE assets are seeking only high quality loans paired with substantial equity invested. Most major CRE asset classes have been hammered by exposure to a variety of economic conditions such as high unemployment and poor underwriting fundamentals. The assets with shorter lease terms and non-credit tenants have all been plagued with higher vacancy rates and a high percentage of troubled and distressed loans.The attraction for a leased asset is that the investor can create a sustainable revenue stream by renting the asset to a tenant. In order to achieve the highest return on investment, most major asset classes require a professional manager to assist with collecting rents, maintenance, and marketing, which eats away a substantial portion of profits. The multi-family and office sectors are sometimes referred to as the 3 T's - toilets, trash, and tenants - which keep all landlords awake at night. One asset class that provides the least risk and management responsibility is the Single Tenant Net Leased category, referred to as STNL. Unlike other asset types, this low-risk & pain-free investment strategy benefits from credit tenants, long-term leases, and rent bumps.  Credit - Many STNL tenants lease prototypical facilities in order to gain a competitive advantage in the marketplace. For example, the top drug store chains are located on primary intersections with traffic counts adequate for the tenant's business model. Many tenants utilize off-balance sheet lease structures in order to leverage the company's balance sheet with minimum corporate cash invested. Some retailers guarantee rental payments by a parent company that has an investment grade credit rating. Clearly, a company's balance sheet and credit rating are an important component to this investment strategy; however, there are two other important legs to the investment stool. In order to balance the strategy, the investor should also consider the lease structures. Credit - Many STNL tenants lease prototypical facilities in order to gain a competitive advantage in the marketplace. For example, the top drug store chains are located on primary intersections with traffic counts adequate for the tenant's business model. Many tenants utilize off-balance sheet lease structures in order to leverage the company's balance sheet with minimum corporate cash invested. Some retailers guarantee rental payments by a parent company that has an investment grade credit rating. Clearly, a company's balance sheet and credit rating are an important component to this investment strategy; however, there are two other important legs to the investment stool. In order to balance the strategy, the investor should also consider the lease structures.Lease Term - Most STNL Retail leases are between 10 and 25 years. As a comparison, hotels typically lease by the day. Mini-storage rents by the month and Apartments rent by the year. With a long term lease in hand, STNL investors spend considerably less time managing and marketing than owners of other asset classes. Rental Increases - Most STNL assets have rental increases during the base lease term; however, many of the other asset classes have rental increases that are determined by current market conditions. For example, hotel, multi-family, and mini-storage rents are determined by a variety of factors, including supply & demand. Many of these operators have had to decrease rents in order to stabilize occupancy rates and to meet debt service and operating expense requirements. On the other hand, most STNL assets provide for fixed rental increases and some include percentage of sales multipliers. Having growth and income incorporated into a sustainable revenue stream makes the STNL asset class very appealing for many investors. The STNL investor is seeking a fundamentally safe investment strategy where principal preservation and sustainable income (and growth) are a must. Essentially, this investor is seeking a bond-type investment in a real estate wrapper. While you can invest in Walgreen's (WAG) stock paying around 1.8%, alternatively, you can acquire an STNL property leased to Walgreens (with more security than the stock) and achieve an unleveraged return of approximately 6.5% to 7.5%. Most Walgreens leases are 25 years (excluding options) with minimal to no management responsibilities - making this type of investment comparable to a bond. With bond returns at an all time low (e.g., IBM's 1% - 3 year note) and many other CRE classes underwater, now many investors are investing in Single Tenant Net Leased assets as a bond replacement strategy. |

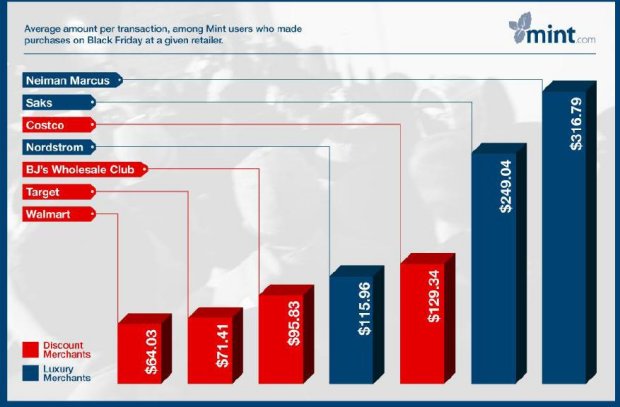

Black Friday Retail Winners Which stores got shoppers to open up their wallets most this year? According to a survey by Mint.com of more than 200,000 consumers who made purchases at seven big discount and luxury retailers. Among the four discounters, Costco saw the highest average amount per transaction; among the three luxury stores, Neiman Marcus inspired the biggest spending. |

GGP Sells Gateway Overlook In November 2010, General Growth Properties (GGP) emerged from the Chapter 11 bankruptcy that it had been operating under since April 2009, and announced that it had sold the Gateway Overlook Shopping Center in Columbia MD. Subject to certain limited conditions, the company said upon closing the sale it expected to reduce its debt by approximately $55 million, and generate excess proceeds of approximately $35 million.Washington REIT (WRIT) acquired the 214,281 square foot class-A shopping center in Columbia, Md., for $88.35 million, or about $412.50 per square foot. Gateway Overlook is a 528,350-square-foot center anchored by Costco and Lowe's Home Improvement. WRIT purchased 214,281 square feet of the center which excludes the Costco and Lowe's parcels.  The property is 90 percent leased to 21 tenants, including national retailers Trader Joe's, Best Buy and Office Depot, as well as Wachovia Bank and Capital One Bank. WRIT funded the acquisition using available cash and its line of credit. WRIT expects to achieve a first year unleveraged yield of 6.9% on a cash basis. David Monahan of Savills was the listing broker. The property is 90 percent leased to 21 tenants, including national retailers Trader Joe's, Best Buy and Office Depot, as well as Wachovia Bank and Capital One Bank. WRIT funded the acquisition using available cash and its line of credit. WRIT expects to achieve a first year unleveraged yield of 6.9% on a cash basis. David Monahan of Savills was the listing broker.The Base Realignment and Closure (BRAC) will relocate 22,000 new jobs within two to four years to Fort Meade, which is five miles southeast of Gateway Overlook. WRIT anticipates the shopping center will benefit from the significant job growth projected in the area. |

Vestar Buys Out Tempe Marketplace Partner In a recapitalization move, Vestar Development Co. and Rockwood Capital acquired Tempe Marketplace for $280 million by buying out an original partner, DLJ/Credit Suisse. In conjunction with the closing, Tempe Marketplace received a new $200 million permanent financing package from German American Capital Corp (GACC).Tempe Marketplace is a 1.3 million-square-foot shopping center on 120-acres located at the Loop 101 and 202 Freeway in Tempe, AZ. Vestar was the developer of Tempe Marketplace and had previously partnered with DLJ/Credit Suisse. Both Rockwood and Vestar made significant investments in the acquisition. Under terms of the deal Vestar will be the managing partner. At $280 million, this transaction was the largest real estate transaction completed in Arizona in 2010 and one of the largest shopping center transactions completed in the United States during 2010. According to Vestar President Rick Kuhle, "Our partnership with Rockwood Capital, when combined with other announcements coming, is the capstone of a busy year that positions Vestar for a very bright future in our key markets." In mid-December, Vestar intends to close on two retail properties in California, totaling approximately 400,000 square feet, and an another acquisition of a major project in Arizona is also expected. |

Fourth Quarter Retail - Malls Improve According to Reis Inc.'s quarterly retail market survey, vacancies fell and rents rose in the fourth quarter at large regional U.S. malls, but smaller strip malls are still wrestling with oversupply, lower rents and a high vacancy rate. And the tepid economic recovery has prompted Reis to expect vacancies at the small strip malls to inch upward throughout the year.In the fourth quarter, vacancies at U.S. strip malls were flat at 10.9 percent, near the 11 percent level last seen during the real estate depression of 1991, according to Reis figures. Tenants rented out just 92,000 more square feet than were vacant, only a fraction of the 474,000 square feet in the prior quarter. Asking rent at strip malls fell 0.1 percent to $19.05 per square foot. Factoring in months of free rent and other perks, effective rent also fell 0.1 percent to $16.56 per square foot, a level last seen five years ago. The numbers were brighter at large regional malls, where the vacancy rate fell for the second straight quarter, down to 8.7 percent in the quarter from 8.8 in the third. According to the Reis survey, asking rents rose for the first time since the third quarter of 2008, up 0.2 percent to $38.79 per square foot. Still, that was about the same as in the second quarter of 2006. Tenants appear to have taken advantage of lower strip mall rents, trading up to better spaces within their existing centers, moving into new centers or into large U.S. malls. Serious demand needs to come back to the point where it entices tenants into the market, either to expand their space or actually get new tenants back to the market place. The higher rents and decreasing vacancy rate should benefit bigger mall owners, such as Simon Property Group Inc, General Growth Properties, Inc. and Macerich Co. Malls are a little bit better positioned coming out of this recession into a recovery because they weren't as prone to the massive overbuilding that we had in some market areas. |

Recent Transactions  Kimco Realty, one of the largest owners and developers of shopping centers in the country, has purchased the Midtown Commons shopping center in Knightdale, NC for $23.84 million, according to Wake County property records. The seller was Crosland. Kimco Realty, one of the largest owners and developers of shopping centers in the country, has purchased the Midtown Commons shopping center in Knightdale, NC for $23.84 million, according to Wake County property records. The seller was Crosland.Kimco, a publicly traded real estate investment trust headquartered in New York, also owns the Shoppes at Midway Plantation, located across Knightdale Boulevard from Midtown Commons. The company also owns stakes in retail centers in Cary, Morrisville, Durham and Raleigh. Midtown Commons sits on 30 acres at the intersection of Knightdale Boulevard and Interstate 540. It includes about 230,000 square feet of retail space. The center's anchor tenants are Best Buy, Dick's Sporting Goods, Kohl's, PetSmart and TJ Maxx. Kimco's portfolio includes 1,465 retail properties and 150 million square feet of leasable space. In another transaction, a landmark Dallas-area shopping center has been purchased by Houston investors. The Richardson Heights Shopping Center on North Central Expressway opened in 1955 when the surrounding neighborhood was first being built.  Over the years the retail center on Belt Line Road has been rebuilt and contains more than 200,000 square feet. Hartman Income REIT Inc. said Tuesday that one of its affiliates bought the property from lenders who foreclosed on the shopping center in 2009. Richardson Heights Shopping Center sold for more than $19 million. Foreclosure filings said that the retail property previously had more than $30 million in debt. Over the years the retail center on Belt Line Road has been rebuilt and contains more than 200,000 square feet. Hartman Income REIT Inc. said Tuesday that one of its affiliates bought the property from lenders who foreclosed on the shopping center in 2009. Richardson Heights Shopping Center sold for more than $19 million. Foreclosure filings said that the retail property previously had more than $30 million in debt.The shopping center is about 56 percent leased with major tenants including TJ Maxx, Party City and Payless Shoe Source. Jennifer Pierson and Beth Pierson of CB Richard Ellis negotiated the transaction. Hartman Income REIT has investment properties with more than 4 million square feet located Houston, Dallas and San Antonio. |

Home | Newsletters | About Us | Contact Us |