|

207 Abbey Lane Lansdale, Pennsylvania 19446 215-855-1800 |

300 E. Raleigh Avenue Diamond Beach, New Jersey 08260 215-990-6663 |

Specializing in Real Estate Appraisal,

Property Tax Consulting & Litigation Support

A Professional Courtesy of:

|

Specializing in Real Estate Appraisal, Property Tax Consulting & Litigation Support |

| SUMMER 2015 |

|

|

In This Issue:

|

|

Ala Moana Stake Sold to TIAA-CREF  TIAA-CREF, one of the largest financial services organizations in the United States, has acquired a 12.5 percent stake in Hawaii’s Ala Moana Center from mall owner General Growth Properties Inc. for $454 million. The announcement follows the 25 percent ownership stake in Ala Moana Center Chicago-based General Growth Properties (NYSE: GGP) sold to AustralianSuper for about $907 million in March. Following this acquisition, GGP now owns 62.5 percent of the state’s largest shopping mall. TIAA-CREF, the nation’s largest manager of U.S. institutional tax-exempt real estate assets, also has an ownership stake with GGP in the Grand Canal Shoppes in Las Vegas.

TIAA-CREF, one of the largest financial services organizations in the United States, has acquired a 12.5 percent stake in Hawaii’s Ala Moana Center from mall owner General Growth Properties Inc. for $454 million. The announcement follows the 25 percent ownership stake in Ala Moana Center Chicago-based General Growth Properties (NYSE: GGP) sold to AustralianSuper for about $907 million in March. Following this acquisition, GGP now owns 62.5 percent of the state’s largest shopping mall. TIAA-CREF, the nation’s largest manager of U.S. institutional tax-exempt real estate assets, also has an ownership stake with GGP in the Grand Canal Shoppes in Las Vegas.Ala Moana Center, which encompasses about 2.2 million square feet, is one of the largest and most productive shopping malls in the world with tenant retail sales of over $1,350 per square foot. The Honolulu mall is currently undergoing a major redevelopment of a former Sears space in the Ewa wing. Upon completion, an additional 660,000 square feet of retail space will be anchored by Bloomingdale’s first store in Hawaii and Nordstrom, which is relocating within the center. In December, TIAA-CREF Realty LLC sold the Town Center of Mililani, one of the largest shopping centers on Oahu, to a joint venture of insurance giant MetLife and Chicago-based real estate investment firm M&J Wilkow for $227.3 million. |

Foreign Investment in Retail Accelerating Investment activity in the retail real estate sector was up 20 percent year-over-year in April, according to Real Capital Analytics (RCA), a New York City-based research firm. Roughly $5.2 billion in retail properties changed hands, and retail prices are on an upswing, increasing 5.5 percent during the first quarter, according to the latest Moody’s/RCA Commercial Property Price Indices. In contrast, the pace of price growth in the retail sector for most of 2014 had been fairly anemic, only 1.6 percent quarterly on average.Foreign investors that are buying today are basing their decisions on the reality that the health of the consumer is improving, which will lead to increases in retail real estate income, according to American Realty Advisors, a real estate investment management firm. These investors are not buying on hope like they were in 2007. They’re buying quality, solid assets that are going to provide income and growth. To that end, cap rates fell to 6.5 percent on a national basis, down 40 basis points year-over¬year, according to RCA. This level puts overall retail cap rates at a new record low, but still attractive to foreign investors. Foreign investor appetite for retail assets is also increasing as yields on retail properties compare favorably with returns they are able to achieve domestically. Foreign investors have completed some of the biggest retail property transactions so far this year. In Hawaii, for example, AustralianSuper, one of Australia’s largest pension funds, purchased a 25 percent stake in Ala Moana Center from General Growth Properties. The fund paid $907 million for a piece of Honolulu’s premier shopping center. International investors are becoming more comfortable looking at a wider range of investment locations, according to JLL’s most recent report tracking cross-border investing. Honolulu was one of the Top 10 cities for cross-border investment during the first quarter. The number of U.S. cities coming into the Top 20 continues to increase as investors search ever further for investment opportunities as risk appetite increases and access to finance improves in more locations. |

Retail Cap Rates Hit Historic Lows Equity continues to enter the commercial real estate sector and push down cap rates for net lease properties, according to a new report from The Boulder Group, a commercial real estate firm located in suburban Chicago. After hovering steady at 6.5% for several quarters, cap rates in the first quarter of 2015 for the single tenant net lease retail sector reached a new historic low of 6.4%. Furthermore, a renewed faith in the nation’s industrial sector resulted in a precipitous drop from 8.03% to 7.7% for industrial properties. Office cap rates rose slightly to 7.35%.Retail assets have long commanded the lowest cap rates due to demand from private and 1031 investors who prefer retail over office and industrial due to their familiarity with the tenants. Brand name is what often attracts investors initially and then they move on to the other criteria. Retail properties typically have long leases, lower prices and triple net lease structures that allow these owners to remain largely passive. Investors are expected to continue to show the most interest in retail properties. And 1031 investors will continue to dominate the net lease market because they can pay more than institutions due to tax benefits received and an ability to accept lower returns. In today’s market, most institutions are unable to get the yield they need under a 6.25% cap rate. Most investors are looking for newly-constructed assets with investment-grade tenants, and those types of properties are in short supply, and generate a great deal of competition when they hit the market. For example, Boulder’s research found that newly-constructed Walgreens, McDonald’s and 7-Eleven properties saw cap rate declines of 5, 25 and 13 basis points, respectively, in the fourth quarter 2014. As limited opportunities exist for long term leased properties to investment grade tenants when compared to the investor demand, these assets are commanding the highest prices. Recently constructed Walgreens, CVS and Family Dollar properties experienced cap rate compression of 25, 12 and 25 basis points, respectively, in the first quarter 2015. The net lease market should remain robust for the rest of the year. However, Boulder also expects that investors will carefully watch out for a boost in interest rates and subsequent softening in asset pricing. Sellers will continue to aggressively price assets in attempt to achieve favorable cap rates in sale transactions; however, the expectation is that cap rates should remain relatively stable in the upcoming quarters especially because of likely interest rate hikes by the Federal Reserve expected to begin in the Fall of 2015 or early 2016. |

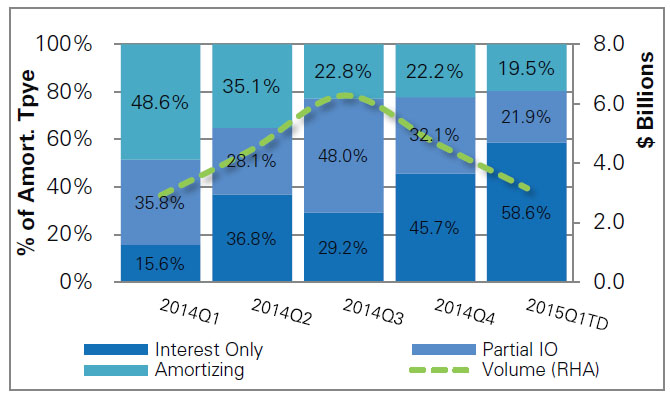

Lending Trends in New Retail Landscape Issuance of retail loans in the CMBS market has been trending upward since the recession despite a slight drop in 2014. Beginning in 2012, single asset/single borrower deals accounted for a growing proportion of annual issuance. The large trophy type assets or portfolios financed by these deals, paired with their relatively easy-to-analyze structure, made them more appealing to wary CMBS investors. Growing use of this deal type also supports the theory that the capital markets are shifting their assets toward high-end, luxury, prime-location retail properties, according to a recent report by Trepp, a leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. As more capital enters the market and lenders compete harder for lending assignments, underwriting standards are on the radar of investors and ratings agencies. One measure of underwriting standards is the percentage of interest-only (IO) loans being originated in CMBS. Interest-only loans have made up a growing proportion of new retail origination over the last year. In general, IO terms are considered riskier than amortizing loans that pay down principal over their term.

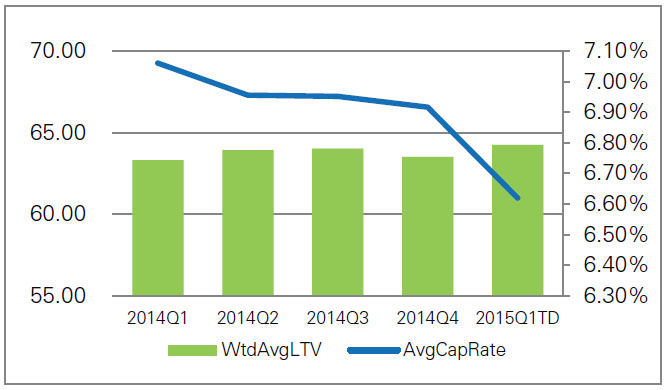

As more capital enters the market and lenders compete harder for lending assignments, underwriting standards are on the radar of investors and ratings agencies. One measure of underwriting standards is the percentage of interest-only (IO) loans being originated in CMBS. Interest-only loans have made up a growing proportion of new retail origination over the last year. In general, IO terms are considered riskier than amortizing loans that pay down principal over their term. The loan-to-value ratios on loans being issued also serve as a good measure of where underwriting standards are in the market. In the case of retail loans, weighted average LTVs do not give much away, but it does appear that lenders are originating loans at slightly higher leverage points so far in 2015. One reason LTVs may be staying fairly flat is a coinciding drop in capitalization rates. Cap rates measure net operating income (NOI) in relation to property value, so the downward trend in cap rates implies that property values are increasing for the same amount of NOI.

The loan-to-value ratios on loans being issued also serve as a good measure of where underwriting standards are in the market. In the case of retail loans, weighted average LTVs do not give much away, but it does appear that lenders are originating loans at slightly higher leverage points so far in 2015. One reason LTVs may be staying fairly flat is a coinciding drop in capitalization rates. Cap rates measure net operating income (NOI) in relation to property value, so the downward trend in cap rates implies that property values are increasing for the same amount of NOI.Rents in urban markets will remain competitive as the move toward urbanization continues and millennials stay unmarried and live in cities longer than the generation before them. Large anchors in malls continue to struggle to stay relevant, and many staples in the industry have either faded, like Sears, or fallen, like RadioShack after filing for bankruptcy in February 2015. Now, both companies are trying out the store-within-a-store model, with Sears carving up parcels to sublease unnecessary space, and RadioShack teaming up with Sprint to lower expenses and better utilize their existing square footage. Many middle-of-the-market malls continue to underperform, some of which have gone completely dark, while high-end shopping centers benefit from access to capital and higher foot traffic. Simon Property Group’s recent bids for Macerich may point to a trend toward consolidation in the retail REIT market that could advance the process of culling underperforming assets and investing in high performing properties. Ultimately, owners and tenants will have to revitalize space by integrating technology to enhance consumer engagement and compete with online outlets with less overhead. The high volume of retail loans coming due over the next three years will lead to increasing new CMBS origination in this space. However, many of the properties up for refinancing will be reappraised in a retail environment very different from what it was ten years ago. Depending on the landscape in the next five years, this could put pressure on borrowers to contribute more capital or sell properties at discounted values. |

|

Recent Transactions Nationwide, transaction volume for good quality retail properties continues to be strong. Here’s a look at some of the recent deals:

|

AVG to Present at IAAO Annual Conference American Valuation Group, Inc. announced that Mark T. Kenney, MAI, SRPA, MRICS, MBA, President of American Valuation Group, Inc. was invited to make a presentation entitled “Tax Appeal Litigation: One Expert’s Perspective” at the 2015 International Association of Assessing Officers’ (IAAO) Annual Conference to be held in September 2015 at the J.W. Marriott Hotel in Indianapolis, IN.In addition to national department store and big box tax appeal experience, American Valuation Group, Inc. was retained for appraisal and litigation support services involving the King of Prussia Mall, Mayfair Mall, Palisades Center, Westfield Trumbull Mall, Eden Prairie Center, The Maine Mall, Landmark Mall, Coral Ridge Mall, Glenbrook Square mall, River Ridge Mall, Quaker Bridge Mall, and Plymouth Meeting Mall tax appeal litigations. He also appraised and consulted on the Mall of America, the largest mega-mall in the U.S. Mark T. Kenney, MAI, SRPA, MRICS, MBA, President of American Valuation Group, Inc., is the author of “Business Enterprise Value: The Debate Continues,” and other shopping mall articles that appeared in The Appraisal Journal, a leading industry journal published by the Appraisal Institute. American Valuation Group, Inc. is a leader in the appraisal of shopping malls and shopping centers, and specializes in property tax appraisal and litigation support nationwide. |

Home | Newsletters | About Us | Contact Us |